We spend money to purchase goods and services, isn’t it? Our spending power is represented by the quality of cash or liquid assets circulating in an economy.Now, think about what will happen if the money supply increases without control. Yes, this will lead to a serious problem- Inflation. An increase in the money supply will result in inflation, and a decrease in money leads to a complex situation called deflation.

So, to control such situations, we need to define monetary aggregates and calculate the total money circulation in India. Now, we will explore the concept of money supply.

MONETARY AGGREGATES OR MEASURES OF MONEY SUPPLY.

The total volume of money in circulation among the people at a particular point in time is called the money supply. In other words, the total amount of currency and demand deposits held by the non-bank public can be used to make payments.

There are various concepts of the money supply, and this difference is based on the difference in money’s liquidity. It ranges from narrow money (the conventional measure of the money supply) to broad money (easily converted to cash).

WHAT DO YOU MEAN BY MONEY LIQUIDTY?

Liquidity means how quickly a person can use a financial asset to buy a good or service.

Imagine you need to pay for your breakfast or lunch. Now, you have options like cash, UPI, credit card or debit card to pay.

Cash in your wallet can be easily used because it is accepted all over India. If the hotel does not have a POS machine or UPI QR code, you must go to an ATM or bank to draw money. In this case, your savings account is less liquid.

Due to the popularity of UPI and POS machines nowadays, paying is easy, and the difficulty of using an account is reduced loss.

MONETARY AGGREGATES IN INDIA

M0:

It is the sum of cash in circulation plus the bank’s reserve with the reserve bank or central bank.

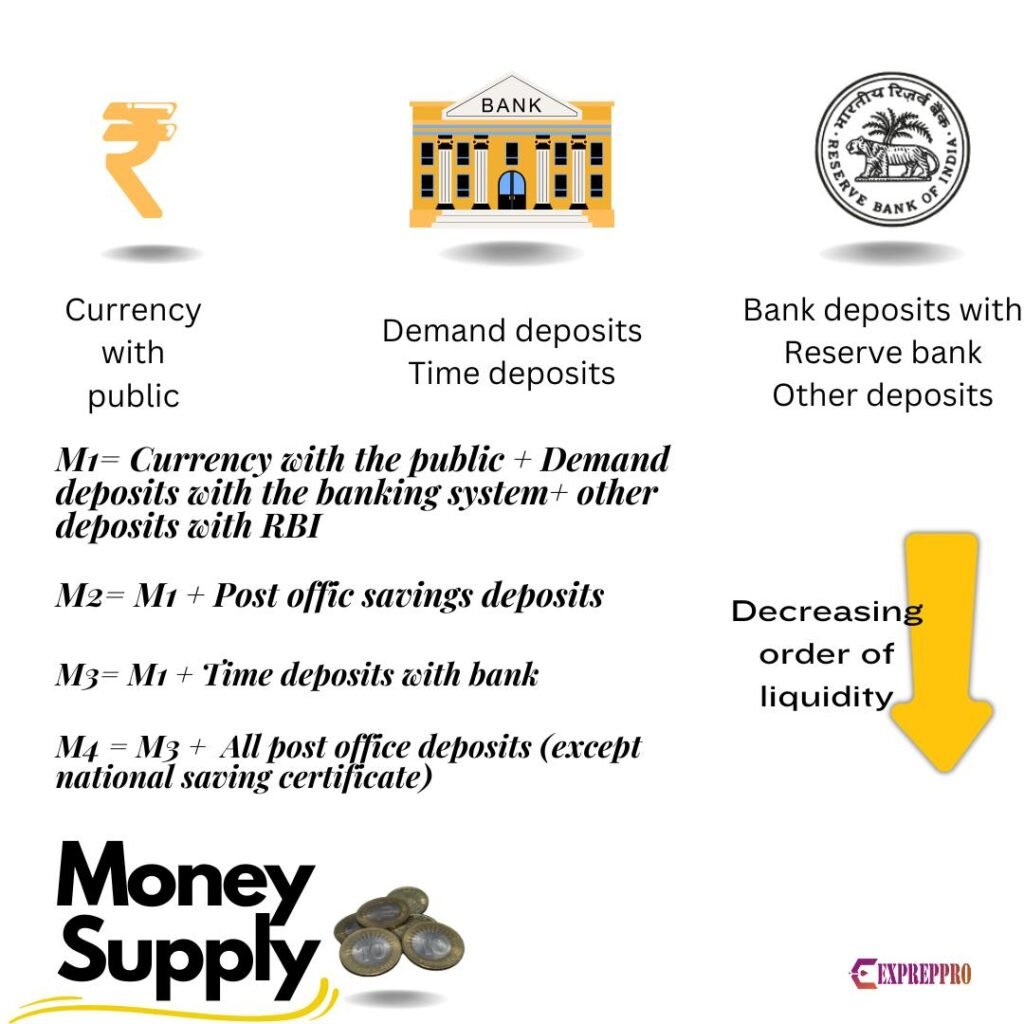

M1:

Currency with the public plus demand deposits of the public.

It is the most narrow definition of the money supply, and it includes coins, currency in circulation, current account and deposit accounts transferable by cheques, and traveller’s cheques.

Nowadays, travellers’ cheques are not commonly used but are still considered while calculating M1. They can be purchased from banks and non-banking companies. However, only non-bank-issued traveller’s cheques are considered separately in M1. They constitute the smallest component of M1.

M2:

It is M1 plus post office savings deposits.

In other countries like the U.S.A., M2 means the currency in circulation plus savings accounts and non-interest-bearing bank deposits.

M2 usually includes saving deposits, for which we cannot use a cheque directly, but we can easily withdraw money using other methods.

M3:

M1 plus time deposits of the public with banks. This is known as broad money.

Time deposits are accounts that the depositor is committed to keep intact for a certain period in return for a higher interest rate.

Interestingly, the components of M3 come closest to the universal definition of money.

M4:

M3 plus total post office deposits ( excluding national savings certificates).

M1 and M2 are known as narrow money. M3 and M4 are known as broad money. M1 to M4 gradations are in decreasing order of liquidity. M1 is the most liquid and easy for transactions. M4 is the least liquid of all, and M3 is the most commonly used measure.

M0 is compiled weekly, and M1, M2 and M3 are compiled fortnightly.

THE CASE OF PLASTIC MONEY LIKE CREDIT CARD AND DEBIT CARD.

When we have a card or UPI, the user can quickly transfer money directly to another account in real time without any trouble.

Now, it is important to consider cards like cheques because, in our definition of money, the deposit that can be drawn with cheques is money and paper cheques or cards.

In the case of credit cards, the situation is not different. It is not considered money; instead, it is considered a short-term loan.

Technically, it is one method of drawing money, and having more credit or debit cards does not change the volume of money in the economy.

M3C:

It is M3 plus foreign exchange deposits with banks.

M5:

It is M4 plus building society deposits. M5 is otherwise known as money stock.

M3C and M5 are not commonly used in India. Another critical point is that certain items are excluded from the narrow money in India.

Cash is excluded from money supply calculations because these coins and currencies are held by banks and not by the people.

While considering money supply, we exclude the stock of gold that serves as international money for international transactions. Since it is not permitted as a recognised transaction inside the country, we must exclude it.

FOUR NEW CONCEPTS OF MONEY AGGREGATES

M1:

currency + demand deposits+ other deposits.

M2:

M1+ time liability portion of savings deposits with bank + CDs issued by the banks+ term deposits maturing within one year (excluding FCNR(B) deposits).

M3:

M2+ term deposits over one year+ term borrowing from ‘Non-Depository’ Financial Corporations by the Banking System.

M3 is now more popular in India, and with this new M3 concept, banks efficiently manage their lending programs.

M4:

At present, as per reversed calculation, it is abolished.

IMPROVEMENTS IN M2 AND M3 WHEN COMPARED TO ORIGINAL CALCULATIONS.

- Post office savings and deposits are excluded from the calculation.

- Bank savings and term deposits are divided into short-term with below one-year maturity and long-term with above one-year maturity.

- Call money and short-term borrowing of banks are included in the new calculation system.

Under current conditions, RBI doesn’t include post office savings in preparing monetary aggregates.

On the other hand, RBI uses postal deposits to calculate liquidity aggregates(L1 and L2).

SOURCES AFFECTING MONEY SUPPLY.

A couple of factors influence the aggregate money supply in India. Let’s examine these factors.

1. NET BANK CREDIT TO THE GOVERNMENT

In India, the net bank credit to the government is composed of net RBI credit to the central and state governments and other banks’ credit to the government. This will increase the money supply.

When the government borrows money from the public, it will reduce the money supply because cash is transferred from the general public to the government.

2. BANK CREDIT TO THE COMMERCIAL SECTOR

When a bank lends to a person, it creates more fresh deposits because the money spent will return to the banking system. This is called credit creation or deposit multiplication.

3. GOVERNMENT’S CURRENCY LIABILITIES TO THE PUBLIC

The government’s currency liabilities will affect the M3. When the government uses its power to issue more currency, it will increase the volume of money supply and currency liabilities of the government.

4. NON-MONETARY LIABILITIES OF THE BANKING SECTOR

The non-monetary liabilities of the RBI and other banks influence the country’s money supply.

5. FOREIGN EXCHANGE ASSETS

Whenever RBI buys more foreign currency from the market, it distributes an equal amount of Indian resources to the economy. So when the foreign exchange assets increase, the money supply will also increase.

LIQUIDITY AGGREGATES

As per the working group’s report on the money supply in India, the authorities introduced new concepts of liquidity aggregates.

L1:

New M3 + all deposits of post office savings banks, excluding national savings certificates.

L2:

L1 plus term deposits with term lending and refinancing institutions + term borrowing by financial institutions + certificates of deposits issued by financial institutions.

L3:

L2 + public deposits of NBFCs.

The L1 aggregates are similar to M4. L2 is a broader term which also includes deposits of NBFCs.

REVERSE MONEY or HIGH POWERED MONEY IN ECONOMICS

The total liability of the Reserve Bank of India is known as the monetary base or reserve money.

In simple terms, it is the cash held by the public and the banks.

High-power money is otherwise known as reserve money or M0.

The ability of the banking system to create deposit money in a country depends on the amount of reserve money available and the share of reserve money which the general public retains in the form of cash.

Reserve money is composed of:

- Currency in circulation with the public (C).

- Other deposits with RBI (OD). (Some privileged persons like governors and deputy governors can hold sach or money with RBI. This form of money held with RBI is called OD or other deposits with RBI)

- Cash reserves of banks (CR).

Reserve money or RM = C + OD + CR

Another factor that determines the banking system’s ability to generate deposit money is the deposit multiplier, which depends on the currency deposit ratio. Creating more deposits will increase the money supply.

MONEY MULTIPLIER

When banks lend money, a part of that money is further deposited in banks after passing through many hands. This deposit is again used to lend money to the public. This cycle creates additional money in the economy. This is known as money multiplier.

Money multiplier = 1/r.

r is the reserve money.

CURRENCY DEPOSIT RATIO

The ratio of money the public holds in currency to that they keep in bank deposits.

It mirrors people’s preference for liquidity.

Our country’s cash deposit ratio increases during the festival season as people convert deposits to cash balances to satisfy additional expenditures during festival times.

An increased currency deposit ratio means the general public holds more currency with them.

CURRENT MONETARY AGGREGATE STATUS

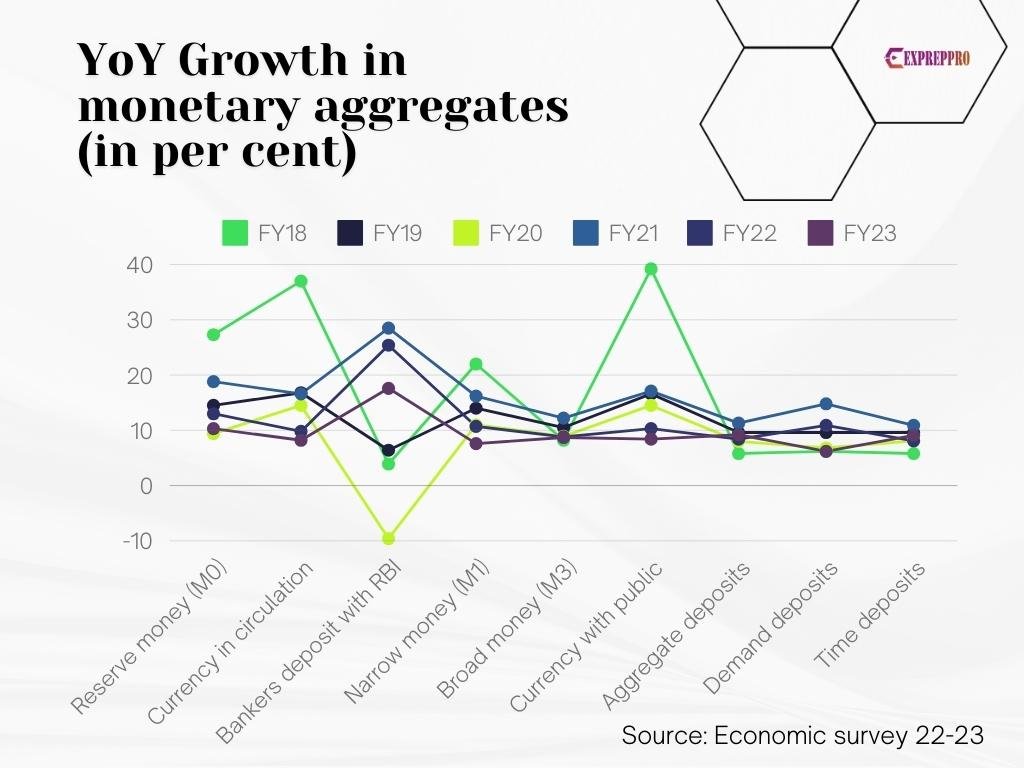

- As of December 30 2022, M0 or reserve money increased by 10.3 per cent year on year. In 2021, it was 13 percent.

- The growth in currency was stable except for a marginal change due to the Russian war.

- The expansion in M0 during the 2023 financial year was mainly due to bankers’s deposits with the RBI.

- As of 2022 December 30, M3 or broad money increased by 8.7 per cent year on year. Aggregate deposits were the most significant component that contributed most to this expansion. Other sources that contributed to the increase in M3 were net bank credit and bank credit to the commercial sector.

- The money multiplier has broadly remained stable at a level of 5.1 per cent.

- The adjusted money multiplier was lower at 4.3 per cent at the beginning of the 2023 financial year.

- M0 adjusted for the reverse repo was much closer to M0.